Developing a Competitive Advantage with a Customer Portal for Tracking Mortgage Applications

By digitally transforming their reporting and tracking process, The Mortgage Store increased their reporting frequency by 5x and improved the customer experience, all while saving half a week of staff time.

Client

The Mortgage Store

Client since

2017

Services provided

Customer portal, 3rd party system integrations, web application, scaleable Azure architecture, system monitoring, operational digital transformation.

Case study on the mortgage store

The Problem

The Mortgage Store is a team of mortgage advisors helping UK customers obtain mortgages.

An important part of the business is the service they offer to housebuilders, helping their customers obtain mortgages to buy new build homes.

A primary challenge for new build financing is that the process must complete within 30 days. Any blockers therefore need to be identified quickly to ensure the process completes in time.

When The Mortgage Store came to Steer73, the process of monitoring the progress of mortgages and reporting back to the housebuilders was manual, slow and very labour-intensive. It involved logging into the industry standard system, Mortgage Brain, manually finding relevant data, typing it into an Excel spreadsheet and sending it individually to each housebuilder.

This took a member of staff at least half a week to complete and meant that housebuilders only got an update twice a week. This doesn't take into account the time taken up with queries coming back from the builders.

Hand-typed Excel spreadsheets are also not an ideal format for housebuilders to receive this data.

The end result was a slow, inefficient process that didn't optimally support the business or their clients.

Characteristics of the project

Complex system integrations & data access

The primary source of data was the industry standard system, Mortgage Brain.

To provide efficiency savings to The Mortgage Store, and to deliver quality and speed improvements to their clients, it was essential that the solution we built integrated with Mortgage Brain and replaced the human actions in the process.

Steer73 have a proven set of processes and capabilities when it comes to integrating with 3rd party systems. These were employed to ensure a seamless integration between the systems.

Highly regulated market

The financial services industry in the UK is heavily regulated. Furthermore, the information being worked with (relating to an individual's mortgage application) was highly confidential.

Security and navigating legislative requirements were therefore primary considerations at every stage of the process.

Limited budgets

Although successful, The Mortgage Store are an SME and did not have enterprise budgets to build a solution.

To keep to initial budgets, it was essential to build something effective and efficient. The scope needed to be limited to only those features that delivered on the core value proposition.

As an example, a decision was made to deliver an excellent system to one set of users (the core market), rather than stretching budget across all potential customers.

Replacing manual, human processes, with technology

We were replacing a manual process, with technology. Breaking down the existing process and rebuilding it for a more efficient, digital system, with security at its core, was a primary part of the project.

The solution

From The Mortgage Store client's perspective

We needed to develop a solution that would improve upon a spreadsheet sent across twice a week.

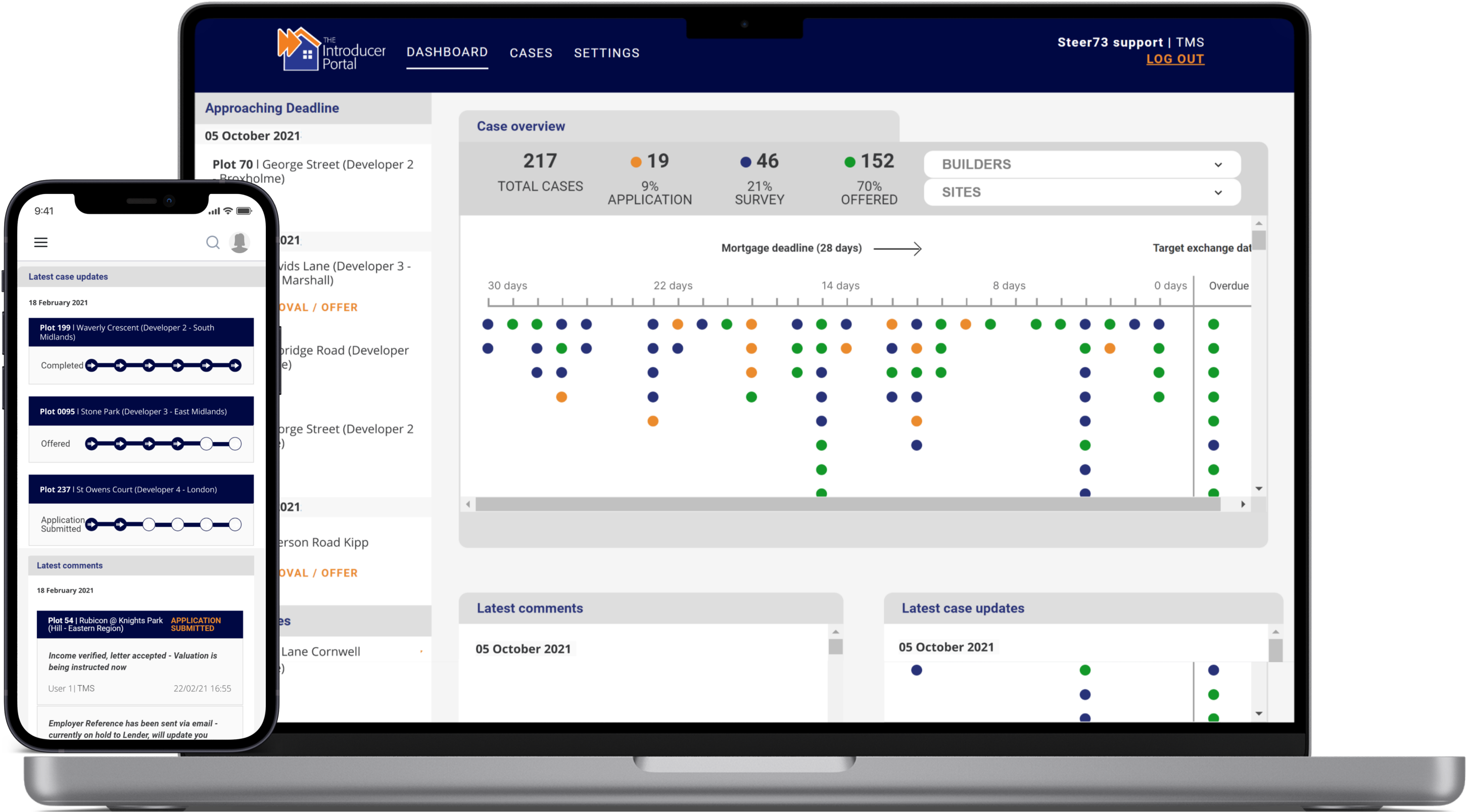

This was a classic case of a customer portal being required. Steer73 built a custom portal, accessed via a web app, that would allow housebuilders to log in and instantly see the status of the mortgages related to their properties. The new system would also send notifications to housebuilders when there were issues or actions that needed to be taken.

From The Mortgage Store's perspective

We wanted to replace the manual process of logging into the mortgage management system, collating the information, filling out an Excel spreadsheet and sending it across to the housebuilders individually.

We developed an integration with Mortgage Brain to extract and collate all the data needed by the customer portal, completely removing the manual, human element. Furthermore, because the housebuilders could log on to the the portal and see notifications, the need to send reports and answer many queries was taken care of by the portal. This saved over half a week's worth of work every week.

The tech

✅ Data integrations

✅ Scalable Azure architecture

✅ System monitoring

Delivery methodology

❌ Agile

Product services

✅ Business process mapping

✅ Workshops

✅ UX and UI design

✅ Requirements analysis and definition

✅ Data analysis

We increased reporting frequency from twice a week to twice a day while saving half a week of staff time.

Business impact

For The Mortgage Store

✅ Revenue upside via better customer engagement and delivering a better customer experience.

✅ Operational savings. The system eliminated the regular manual workflow of one of their employees and freed up circa half a week of staff time.

✅ Happier employees via the reduction of tiresome, repetitive manual tasks.

For The Mortgage Store's customers

✅ More up to date and regular updates on the status of their mortgages.

✅ Notifications to alert them of any issues with mortgages.

✅ Increased chance of completing mortgages within the 30 day window via notifications and more accurate and up to date information.

✅ A more frictionless workflow and experience for their employees and customers.

Input your search keywords and press Enter.